Sell-side Advisory Support for a $450 mn Airport Transaction in Philippines

Client

One of the fastest growing infrastructure enterprise and 2nd largest airport developer in the world working across multiple geographies.

Issue

Client had decided to divest their stake in their Philippines airport and were evaluating value deals. The buyer was a large Philippines conglomerate with USD 5.4Bn market cap with interest in Utilities, Infrastructure, Banking, and Industrials

We have a deep-rooted relationship with the client, and for this asset, we have assisted them right from the inception across multiple areas including bid strategy, transition support, operations, and business development.

Approach

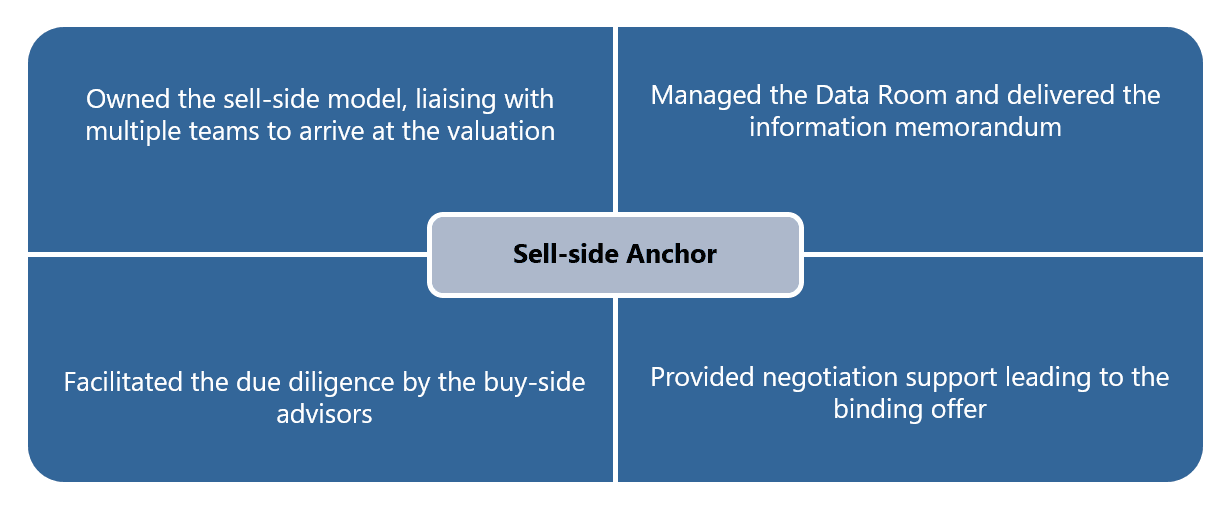

We anchored the sell-side for the client by owning the financial model, preparing the marketing document, arriving at the valuation of the company as well as facilitating due diligence by the buy-side.

We developed a detailed financial model with major assumptions such as traffic, commercial inputs corroborated with consultants and SMEs. We identified the target valuation for the asset and its JVs using a DCF approach aligning it with client’s aspirations.

We also authored the Information memorandum for the transaction, detailing the key aspects of the asset and managed the Virtual Data Room (VDR) for the sell-side addressing the requests from buy-side consultants.

We also authored the Information memorandum for the transaction, detailing the key aspects of the asset and managed the Virtual Data Room (VDR) for the sell-side addressing the requests from buy-side consultants.

As the engagement progressed to the negotiation stage, we developed an understanding of the buy-side offer and offered analysis to negotiate and bridge the gap through a performance ratchet. We performed detailed simulation to understand the key drivers of the valuation to support the client’s decision on the final offer.

Engagement ROI

On the basis of our models and corroboration of inputs from SMEs, we identified the target valuation of the asset and delivered the financial model and Information memorandum for the transaction. We also supported the buy-side negotiations leading to a binding offer of ~USD 450Mn and structuring of a performance based earnout.